Berita & Acara

TDM’s healthcare business in focus

.png)

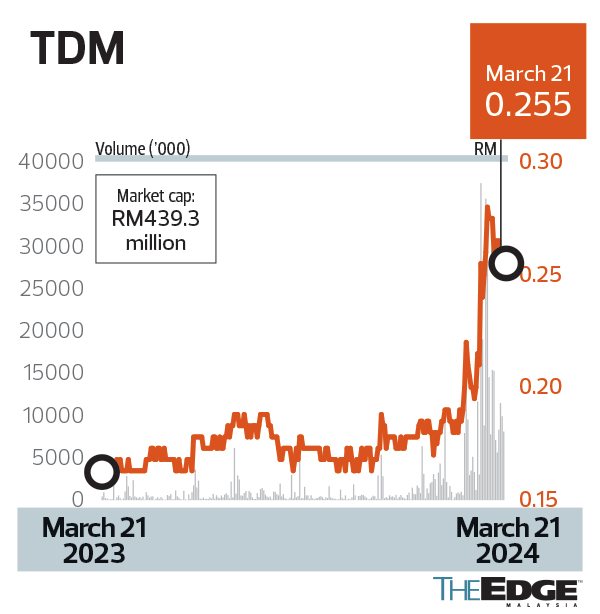

THE disposal of Ramsay Sime Darby Health Care Sdn Bhd (RSDH) to Columbia Asia Healthcare Sdn Bhd for RM5.7 billion cash late last year has set a new benchmark for the valuation of private hospital operators in Malaysia while generating investor interest in similar players, including TDM Bhd.

Majority owned by the Terengganu government, the plantation and healthcare group has seen its share price rally by close to 40% year to date to last Thursday’s close of 25.5 sen a share, valuing the group at RM439.3 million.

In the past, there was talk of a spin-off of the healthcare business held under wholly-owned KMI Healthcare Sdn Bhd. Is the plan back on the table?

“There is an option for KMI Healthcare to stay private or to go for listing. However, as a matter of policy, we do not comment on speculative matters or ongoing discussions.

“Our focus remains on exploring various strategic options to support our growth and create value for our stakeholders. Currently, we have nothing specific to announce, and our focus remains on our core business operations,” KMI Healthcare CEO Dr Rayney Azmi Ali tells The Edge.

KMI Healthcare operates five hospitals in Taman Desa and Kelana Jaya in the Klang Valley, and Kuantan and Kuala Terengganu on the peninsula’s east coast, as well as Tawau in Sabah.

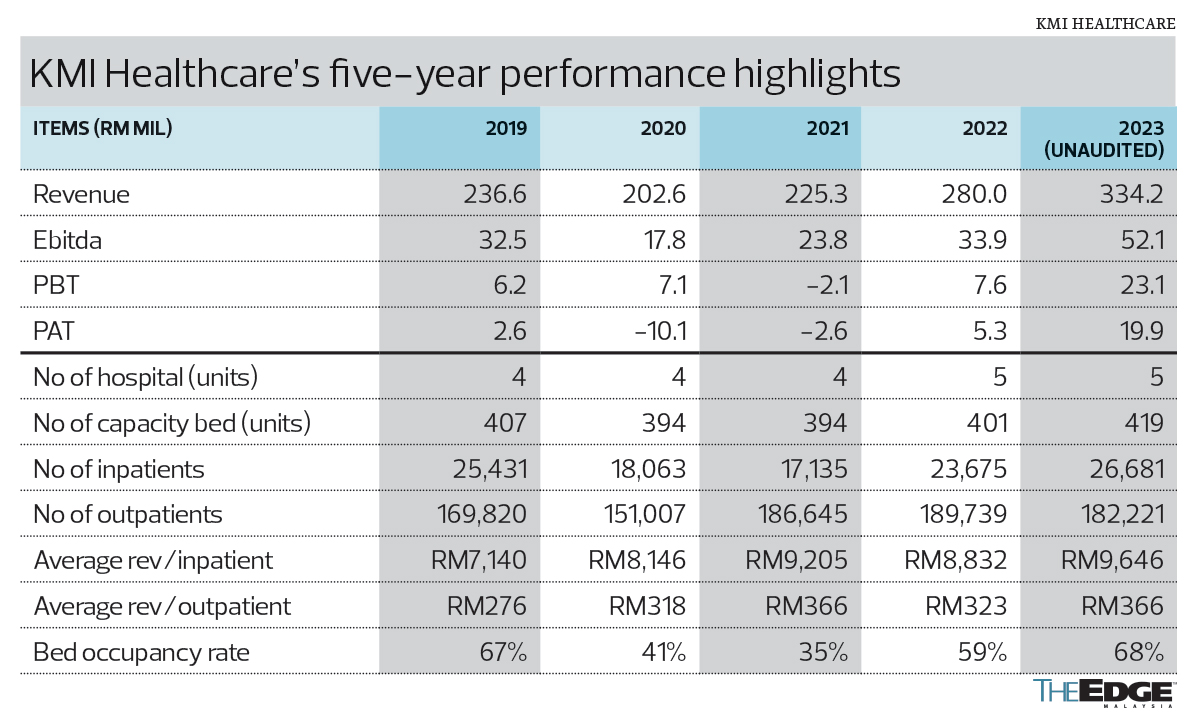

For its financial year ended Dec 31, 2023 (FY2023), TDM’s healthcare business has overtaken plantation as the bigger earnings contributor, registering a profit before tax of RM31.29 million compared with RM14.06 million.

According to Rayney, a medical doctor by training, the group is focused on expanding the healthcare business through greenfield and brownfield development, which includes the recent acquisition of Hospital Bersalin Razif, a 35-bed maternity hospital in Klang, Selangor, and the development of a 100-bed hospital in Chukai, Terengganu, which is expected to be completed in 2028.

The group has also outlined its Vision 2027 strategic business plan, which among others, envisions a profit after tax (PAT) of RM32 million, with a PAT margin of 4% and 880-bed capacity across its hospitals.

These will be achieved by handling 84,028 inpatients and 652,740 outpatients by 2027, says Rayney in a response to The Edge’s questions.

TDM undervalued?

At RM5.7 billion, RSDH is valued at an enterprise multiple (enterprise value [EV]/earnings before interest, taxes, depreciation and amortisation [Ebitda]) of 20.1 times, which is higher than the current EV/Ebitda of listed private hospital operators KPJ Healthcare Bhd’s 14.17 times and IHH Healthcare Bhd’s 11.28 times.

Thanks to the RSDH deal, analysts covering Sunway Bhd have raised the EV/Ebitda multiple for Sunway Healthcare Group (SHG), which is slated to be listed on Bursa Malaysia by 2024, to between 20 and 24 times.

It is worth noting that year to date, Sunway’s share price has risen 70.42% to Thursday’s closing price of RM3.47.

TDM’s KMI Healthcare, with 419 beds, is much smaller than SHG and RSDH — both operate at least three times the number of beds and registered Ebitda in the RM300 million mark.

What would be a fair EV/Ebitda multiple for KMI Healthcare? Taking a third of the 20 times on which RSDH was sold, or seven times, KMI Healthcare is valued at about RM365 million based on its latest reported Ebitda of RM52.1 million.

Based on TDM’s market cap of RM430.89 million and KMI Healthcare’s valuation of about RM365 million, this would mean the market has ascribed only RM65.89 million for the plantation segment. At an EV/Ebitda of eight times, the plantation business is almost free.

TDM develops and manages 13 oil palm estates and two palm oil mills in Terengganu. Its planted land bank measures 28,479ha, out of a total hectarage of 41,197.6ha.

It is in the process of selling its plantation assets in Indonesia.

In FY2023, TDM registered an average crude palm oil (CPO) price of RM3,939, some 21% lower than the year before. It produced 59,419 tonnes of CPO while its mills achieved an oil extraction rate of 19.93% compared with 19.21% in FY2022.

Affin Hwang Investment Bank valued KPJ at 11 times EV/Ebitda and IHH at 15 times.

Note the divergence in EV/Ebitda multiples ascribed on SHG and RSDH with those of KPJ and IHH. While the companies which are part of a larger group are valued at more than 20 times EV/Ebitda, KPJ and IHH are valued in the teens.

“Differences in valuations could be attributed to various factors such as hospital size, geographical and target market exposure. Furthermore, SHG is undergoing its growth phase and as such is typically ascribed a higher multiple.

“The divergence of valuation ascribed on SHG, I believe, is primarily due to it still being in its growth stage as it’s in the midst of ramping up hospital capacity for its potential IPO listing,” Andrew Lim, associate director of equity research at Affin Hwang IB, tells The Edge. “The valuations would subsequently normalise once operations have undergone their gestation periods.

“Furthermore, Sunway has been known to have a fast turnaround in its hospital operations, with SMC Velocity being a prime example as it was able to turn profitable in less than two years after its opening.”

The divergence in valuations between SHG and KPJ is also due to their target markets, adds Lim.

SHG’s Ebitda margin is higher than KPJ’s in FY2023, as the bulk of its earnings are currently derived from its main hospital in Sunway City, as opposed to KPJ, which has a wide geographical exposure, he says.

SHG recorded an Ebitda margin of 26% in FY2023, while KPJ reported 21.3%. KMI Healthcare, meanwhile, has a much lower Ebitda margin of 15.6% in FY2023, probably due to its concentration in lower-tier cities or urban areas.

Terkini

-

ACARAWorkplace Health Promotion Workshop

ACARAWorkplace Health Promotion Workshop

-

ACARAKMI East Coast Half Marathon and Fun Run 2024

-

ACARADeveloping a Skilled Workforce at KMI Healthcare through Strategic Collaborations with Bank Islam and University College Bestari (UCB)

ACARADeveloping a Skilled Workforce at KMI Healthcare through Strategic Collaborations with Bank Islam and University College Bestari (UCB)

-

.png) BERITATDM’s healthcare business in focus

BERITATDM’s healthcare business in focus

-

.png) BERITAKMI Healthcare Catat Prestasi Luar Biasa

BERITAKMI Healthcare Catat Prestasi Luar Biasa

-

(1).png) BERITAKMI Healthcare catat peningkatan pendapatan 19% kepada RM332.8 juta bagi 4QFY23

BERITAKMI Healthcare catat peningkatan pendapatan 19% kepada RM332.8 juta bagi 4QFY23

-

.jpg) BERITAKMI Healthcare catat prestasi luar biasa

BERITAKMI Healthcare catat prestasi luar biasa

-

.png) BERITAPendapatan KMI Healthcare meningkat kepada RM332.8 juta

BERITAPendapatan KMI Healthcare meningkat kepada RM332.8 juta

-

BERITASegmen penjagaan Kesihatan TDM rekod peningkatan 18% pendapatan suku keempat 2023

BERITASegmen penjagaan Kesihatan TDM rekod peningkatan 18% pendapatan suku keempat 2023

-

BERITATDM catat keuntungan sebelum cukai RM15 juta

BERITATDM catat keuntungan sebelum cukai RM15 juta

-

.png) BERITABahagian Penjagaan Kesihatan Sumbang Kejayaan TDM

BERITABahagian Penjagaan Kesihatan Sumbang Kejayaan TDM

-

BERITATDM expands healthcare network, invests RM 29.1mil for two new hospitals

BERITATDM expands healthcare network, invests RM 29.1mil for two new hospitals

-

BERITAKMI Healthcare ambil alih Hospital Bersalin Razif

BERITAKMI Healthcare ambil alih Hospital Bersalin Razif

-

BERITAKMI Tandatangani SSA Bersama Hospital Bersalin Razif

BERITAKMI Tandatangani SSA Bersama Hospital Bersalin Razif

-

BERITATDM buy maternity hospital for RM15m, anticipates positive earnings impact

BERITATDM buy maternity hospital for RM15m, anticipates positive earnings impact

-

BERITATDM buys private maternity hospital in Klang for RM15 mil

BERITATDM buys private maternity hospital in Klang for RM15 mil

-

BERITATDM beli hospital bersalin swasta di Klang berharga RM15 juta

BERITATDM beli hospital bersalin swasta di Klang berharga RM15 juta

-

BERITATDM buys private maternity hospital in Klang for RM15mil

BERITATDM buys private maternity hospital in Klang for RM15mil

-

BERITAKMI Healthcare Acquires 100 PCT Stake in Hospital Bersalin Razif

BERITAKMI Healthcare Acquires 100 PCT Stake in Hospital Bersalin Razif

-

BERITAKMI Kuantan Terima Anugerah SOHELP DOSH

BERITAKMI Kuantan Terima Anugerah SOHELP DOSH

-

BERITAKMIKT Komited Tawarkan Perkhidmatan Lebih Komprehensif

BERITAKMIKT Komited Tawarkan Perkhidmatan Lebih Komprehensif

-

BERITAKMIKT Catat Pendapatan Tertinggi Pada 2022

BERITAKMIKT Catat Pendapatan Tertinggi Pada 2022

-

BERITATDM’s Kuala Terengganu hospital posts impressive FY22 results

BERITATDM’s Kuala Terengganu hospital posts impressive FY22 results

-

BERITAPusat perubatan KMI Kuala Terengganu tekad mengorak langkah kekalkan momentum cemerlang

BERITAPusat perubatan KMI Kuala Terengganu tekad mengorak langkah kekalkan momentum cemerlang

-

BERITAKMI Healthcare bina hospital di Kemaman

BERITAKMI Healthcare bina hospital di Kemaman

-

BERITATDM ambil alih tanah bernilai RM14.1 juta untuk pembangunan hospital swasta di Kemaman

BERITATDM ambil alih tanah bernilai RM14.1 juta untuk pembangunan hospital swasta di Kemaman

-

BERITATDM in land acquisition deal in Terengganu

BERITATDM in land acquisition deal in Terengganu

-

BERITATDM bina hospital pakar swasta pertama di Kemaman

BERITATDM bina hospital pakar swasta pertama di Kemaman

-

BERITATerengganu's TDM Bhd to buy Malay Reserve Land in Kemaman to build private hospital

BERITATerengganu's TDM Bhd to buy Malay Reserve Land in Kemaman to build private hospital

-

BERITAHospital KMI Keenam Dibina di Kemaman

BERITAHospital KMI Keenam Dibina di Kemaman

-

BERITAEast Coast belt region to have new hospital - KMI Chukai

BERITAEast Coast belt region to have new hospital - KMI Chukai

-

BERITAHospital mesra ibadah pertama di Perlis

BERITAHospital mesra ibadah pertama di Perlis

-

BERITAKMI Healthcare lancar hospital pakar di Tawau

BERITAKMI Healthcare lancar hospital pakar di Tawau

-

ACARAMajlis Pecah Tanah KMI Chukai Medical Centre

ACARAMajlis Pecah Tanah KMI Chukai Medical Centre

-

ACARAKMI Tawau Medical Centre was officially launched by KMI Healthcare

ACARAKMI Tawau Medical Centre was officially launched by KMI Healthcare

-

BERITAHospital Mesra Ibadah

-

BERITAHospital Mesra Ibadah

-

BERITAKMI Healthcare, PKENPs tandatangan MoU untuk pembangunan kesihatan di Perlis

BERITAKMI Healthcare, PKENPs tandatangan MoU untuk pembangunan kesihatan di Perlis

-

BERITATDM, SEDC Perlis rancang teroka peluang pembangunan penjagaan kesihatan

BERITATDM, SEDC Perlis rancang teroka peluang pembangunan penjagaan kesihatan

-

BERITADua hospital TDM bakal dibina tahun depan

BERITADua hospital TDM bakal dibina tahun depan

-

ACARAKMI Healthcare dan PKENPs Tandatangan MoU untuk Pembangunan Kesihatan di Perlis

-

BERITAKMI Healthcare awarded for the implementation of a religious-friendly programme for patients

BERITAKMI Healthcare awarded for the implementation of a religious-friendly programme for patients

-

BERITATDM, KMI Healthcare kekal taja TSG

BERITATDM, KMI Healthcare kekal taja TSG

-

BERITATRDI: Syarikat Berkaitan Kerajaan Terengganu Gondol Dua Anugerah

BERITATRDI: Syarikat Berkaitan Kerajaan Terengganu Gondol Dua Anugerah

-

BERITAPesakit Islam di 5 hospital KMI dibantu tunai ibadah ketika dalam rawatan

BERITAPesakit Islam di 5 hospital KMI dibantu tunai ibadah ketika dalam rawatan

-

BERITANST: #HEALTH: Including spirituality in healing

BERITANST: #HEALTH: Including spirituality in healing

-

BERITAKUMPULAN MEDIC IMAN RANCANG PERLUAS PERNIAGAAN - BORNEO TODAY

BERITAKUMPULAN MEDIC IMAN RANCANG PERLUAS PERNIAGAAN - BORNEO TODAY

-

BERITAA better 2021 beckons for cleaner and diabetic husband - FMT

BERITAA better 2021 beckons for cleaner and diabetic husband - FMT

-

BERITACOVID-19: Kakitangan diuji negatif, TDMC beroperasi semula sejak semalam - BERNAMA

BERITACOVID-19: Kakitangan diuji negatif, TDMC beroperasi semula sejak semalam - BERNAMA

-

BERITATDM confirms one COVID-19 case at TDMC - The Edge Markets

BERITATDM confirms one COVID-19 case at TDMC - The Edge Markets

-

BERITATaman Desa Medical Centre given all-clear after healthcare workers test negative for Covid-19 - The Edge Markets

BERITATaman Desa Medical Centre given all-clear after healthcare workers test negative for Covid-19 - The Edge Markets

-

BERITATDMC closes infected ward rooms - The Star

BERITATDMC closes infected ward rooms - The Star

-

BERITAPasien Positif Corona di Malaysia Sempat Bepergian ke Jakarta dan Bogor - kumparanNews

BERITAPasien Positif Corona di Malaysia Sempat Bepergian ke Jakarta dan Bogor - kumparanNews

-

BERITATaman Desa Medical Centre closes its infected wards after Covid-19 case - FMT

BERITATaman Desa Medical Centre closes its infected wards after Covid-19 case - FMT

-

BERITACOVID-19: Taman Desa Medical Centre closes all infected ward rooms - BERNAMA

BERITACOVID-19: Taman Desa Medical Centre closes all infected ward rooms - BERNAMA

-

BERITATaman Desa Medical Centre closes wards for disinfection - The Malaysian Insight

BERITATaman Desa Medical Centre closes wards for disinfection - The Malaysian Insight

-

BERITACOVID-19: TDMC Tutup Bilik Rawatan Yang Dijangkiti - Siakap Keli

BERITACOVID-19: TDMC Tutup Bilik Rawatan Yang Dijangkiti - Siakap Keli

-

BERITACovid-19: Taman Desa Medical Centre closes all infected ward rooms - Malay Mail

BERITACovid-19: Taman Desa Medical Centre closes all infected ward rooms - Malay Mail

-

BERITAKTS tawar perkhidmatan jururawat ke rumah pesakit - Utusan Malaysia

BERITAKTS tawar perkhidmatan jururawat ke rumah pesakit - Utusan Malaysia

-

BERITAPengunjung Terengganu disaran lakukan saringan Covid-19 - Kosmo

BERITAPengunjung Terengganu disaran lakukan saringan Covid-19 - Kosmo

-

BERITAKTS Perkenal Rawatan Kesihatan Di Rumah Serendah RM30 - TRDI

BERITAKTS Perkenal Rawatan Kesihatan Di Rumah Serendah RM30 - TRDI

-

BERITAKuala Terengganu Specialist Hospital launches Home Care services - BERNAMA

BERITAKuala Terengganu Specialist Hospital launches Home Care services - BERNAMA

-

BERITATerengganu Terkilan Dengan Kementerian Kesihatan - Berita Harian

BERITATerengganu Terkilan Dengan Kementerian Kesihatan - Berita Harian

-

BERITAInfluenza: Jangan panik, Terengganu terkawal - Astro Awani

BERITAInfluenza: Jangan panik, Terengganu terkawal - Astro Awani

-

BERITAKesedaran menderma organ di Terengganu masih rendah - malaysiakini

BERITAKesedaran menderma organ di Terengganu masih rendah - malaysiakini

-

BERITAMalaysia’s KMI Healthcare Looks To Divest 30% Stake To Fund Expansion - Deal Street Asia

BERITAMalaysia’s KMI Healthcare Looks To Divest 30% Stake To Fund Expansion - Deal Street Asia

-

BERITATDM bakal tawar produk baharu berkaitan rawatan Covid-19 - Kosmo

BERITATDM bakal tawar produk baharu berkaitan rawatan Covid-19 - Kosmo

-

BERITACovid-19: KMI Healthcare Jalankan Bisnes Luar dari Kebiasaan - Sinar Harian

BERITACovid-19: KMI Healthcare Jalankan Bisnes Luar dari Kebiasaan - Sinar Harian

-

.jpg) ARTIKELWorking Out A Balance Life - The Star Media Group #WorkxHealth

ARTIKELWorking Out A Balance Life - The Star Media Group #WorkxHealth

-

BERITAKMI Healthcare Confirms TDMC Health Care Workers Tested Negative for COVID-19

BERITAKMI Healthcare Confirms TDMC Health Care Workers Tested Negative for COVID-19

-

BERITAKMI Healthcare (Kumpulan Medic Iman) Confirms One COVID-19 Case at TDMC

BERITAKMI Healthcare (Kumpulan Medic Iman) Confirms One COVID-19 Case at TDMC

-

BERITAKMC open state-of-the-art Catheterization Laboratory in Kuantan

-

BERITAKerjasama Dua Hala Tingkatkan Mutu Perkhidmatan Perubatan

BERITAKerjasama Dua Hala Tingkatkan Mutu Perkhidmatan Perubatan

-

ARTIKELFrozen Shoulder

ARTIKELFrozen Shoulder

-

ARTIKELTalasemia Diwarisi

ARTIKELTalasemia Diwarisi

-

ARTIKELSusu Badan Susu Terbaik

ARTIKELSusu Badan Susu Terbaik

-

ARTIKELRotavirus Punca Cirit-Birit

ARTIKELRotavirus Punca Cirit-Birit

-

ARTIKELMeningitis Bakteria Lebih Bahaya

ARTIKELMeningitis Bakteria Lebih Bahaya

-

ARTIKELHadapi Bayi Pramatang

ARTIKELHadapi Bayi Pramatang

-

ARTIKELGangguan Saluran Usus

ARTIKELGangguan Saluran Usus

-

ARTIKELApakah itu Frozen Shoulder?

ARTIKELApakah itu Frozen Shoulder?

-

ARTIKELColonoscopy: What & Why

ARTIKELColonoscopy: What & Why

-

ARTIKELTonsilitis Jangkitan Pada Tekak

ARTIKELTonsilitis Jangkitan Pada Tekak

-

ARTIKELFaktor Perangsang Asma

ARTIKELFaktor Perangsang Asma

-

BERITAThe importance of hand hygiene

BERITAThe importance of hand hygiene

-

BERITASultan Mizan rasmi bangunan baru KTS

BERITASultan Mizan rasmi bangunan baru KTS

-

BERITASultan Mizan rasmi hospital pakar KTS

BERITASultan Mizan rasmi hospital pakar KTS

-

BERITASultan Mizan rasmi KTS

BERITASultan Mizan rasmi KTS

.JPG)

.png)